For Nguyen Ngoc, a merchant in Ho Chi Minh City selling blouses and wallets, a typical way to reach online customers is through Facebook. But these customers often ask to switch to online marketplace Shopee for payment.

Ngoc understands why: Shopee is known for free deliveries.

“From the beginning, Shopee has been geared toward low fees. People associate it with free shipping,” Ngoc told Nikkei Asia.

Free deliveries and low commissions are part of Shopee’s aggressive marketing efforts in Vietnam that have helped it to become the country’s most popular ecommerce platform and to grow during the Covid-19 pandemic. Shopee, owned by Singapore-based tech group Sea, received 62m monthly visits in Vietnam in the third quarter of 2020, up more than 80 per cent from a year earlier.

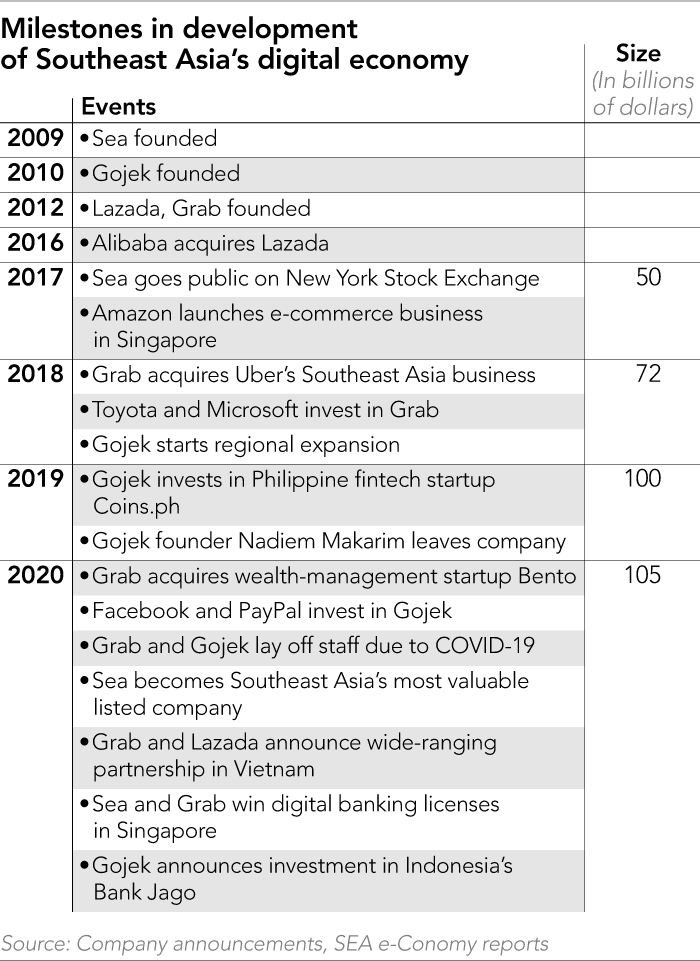

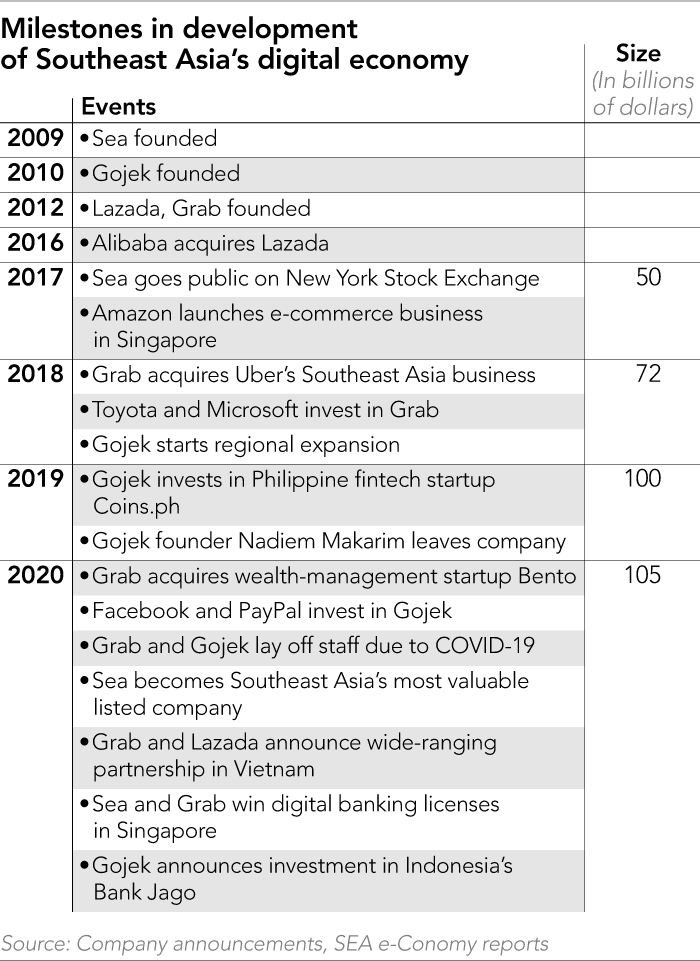

Shopee’s bullish expansion in Vietnam is part of a new phase of development in south-east Asia’s $100bn digital economy. In the post-pandemic era, ecommerce will be the cornerstone of a new range of alliances, and rivals are racing to build entire ecosystems to serve as many customer needs as possible.

This article is from Nikkei Asia, a global publication with a uniquely Asian perspective on politics, the economy, business and international affairs. Our own correspondents and outside commentators from around the world share their views on Asia, while our Asia300 section provides in-depth coverage of 300 of the biggest and fastest-growing listed companies from 11 economies outside Japan.

Subscribe | Group subscriptions

The growth of the region’s best-known tech start-ups, such as Singapore-based Grab and Indonesia’s Gojek, was spurred by services such as ride-hailing. Now the rapid rise of Sea — which has become south-east Asia’s most valuable company, worth about $100bn — is triggering fresh tie-ups and acquisitions that are set to redraw the landscape in 2021 and beyond as economies start to recover.

Backed by cash flow from its gaming business, US-listed Sea is investing heavily in ecommerce and digital financial services. In the July-September quarter of 2020, revenues for its ecommerce unit, which covers Vietnam and other countries, rose 2.7 times from a year earlier to $618m, while its operating loss widened from $277m to $338m, mainly as a result of its campaign to gain market share.

The effort seems to be paying off. According to data from iPrice Group, Shopee was the most-visited site in Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam in the third quarter of 2020. Only a year earlier, Lazada (owned since 2016 by China’s Alibaba Group Holding) was number one in the Philippines, Singapore and Thailand, while Indonesia’s most-visited site was Tokopedia, the ecommerce group backed by Japan’s SoftBank Group.

Sea’s rise is forcing a response. Lazada has joined with Grab in Vietnam, while Grab and Gojek have made new investments in digital finance businesses.

Until 2015, says Edwin Muljono, an Indonesia-based consultant at YCP Solidiance, south-east Asia’s digital economy “was in the growth stage of the industry life cycle, with many new players emerging [and] rapidly increasing demand with relatively low competition”.

Now he says the market is in a “shakeout stage” — which he dates to the acquisition by Grab of Uber’s regional business in 2018. “Albeit continuing double-digit growth, the market has started to mature, and consolidation seems to be on the horizon,” he said.

Emphasising the consolidation agenda, and the shift in priorities, Nikkei Asia learned this month that Gojek is in merger talks with Tokopedia — a potential alliance that would create a huge tech group in Indonesia, south-east Asia’s biggest economy. Gojek has also been discussing a possible merger with Grab.

South-east Asia is a hunting ground. Grab and Gojek have become the biggest, last valued at $14bn and $10bn respectively, but the region is home to 12 start-ups valued at $1bn or more, according to a study by Google, Temasek Holdings and Bain & Company. In Tokopedia and Bukalapak, Indonesia has two ecommerce unicorns that are empowering millions of local merchants, including many mom-and-pop shops, to sell online through their platforms.

This landscape is being changed by the pandemic. Ride-hailing was hit hard by the travel curbs and working-from-home trend, with Grab and Gojek cutting 5 per cent and 9 per cent of staff respectively in mid-2020. But demand for ecommerce and food deliveries soared, and this will probably continue in the post-pandemic era.

Investor sentiment chilled early in the pandemic. The total amount of capital invested in south-east Asian start-ups fell 13 per cent in the first half of 2020 from a year earlier, according to data compiled by Singapore’s Cento Ventures. Travel curbs made fundraising meetings and due diligence difficult.

But growth trends are expected to remain intact. “The long-term outlook for south-east Asia’s digital economy remains more robust than ever,” according to Aadarsh Baijal, a partner at Bain & Company, who said factors such as “greater trust in technology” and “market forces creating significantly greater online supply” would give a permanent boost to the digital economy.

Vietnam is a prime example of the new battlefield and the prizes still to be gained. Its digital economies, including ecommerce, food delivery and ride-hailing, grew to $14bn in 2020, up 16 per cent from the previous year, and will expand to $52bn in 2025, according to the Google-led report.

Shopee is now far outperforming its rivals in the country. Next is The Gioi Di Dong, also known as Mobile World, which had 29m monthly visits during the same period. Tiki, a local ecommerce operator, followed with 22m, and Lazada had 20m, according to iPrice data.

Tuan Anh, managing director for Shopee in Vietnam, told Nikkei Asia that Shopee has attracted “users into our ecosystem by ramping up the integration of e-payments”.

To counter Shopee, Singapore-based Lazada in November joined with Grab in Vietnam, a wide-ranging partnership that offers Grab a way to strengthen its focus on ecommerce.

“We’re really hopeful that we’ll be able to bring all of Grab to our ecommerce partners,” said Ming Maa, Grab’s president, at a start-up event in late November.

“It’s not just last-mile delivery, but hopefully partnering with our payment solutions, partnering with some of our local services so that we can really integrate the customer experience and provide a much richer experience for our customers,” he added.

Lazada taps Grab’s customer and driver networks, pointing shoppers to Grab’s food delivery, and will use Grab’s parcel delivery service to ship products. Grab also refers its app users to Lazada. Both Lazada parent Alibaba and Grab are backed by Japan’s SoftBank Group.

Meanwhile, Tiki promises two-hour deliveries thanks to the end-to-end supply chain it has with nationwide fulfilment centre systems. It also launched its own credit card with a local bank in 2020, showing that it wants to go beyond ecommerce operations.

The partnerships forged in Vietnam by Lazada and Grab could possibly be replicated in other south-east Asian markets. “I see a lot more that we can be working on together,” said Mr Maa. He has already taken the partnership route in Thailand for marketing campaigns around November 11 “Singles Day” sales.

Lazada, together with Google, in November started digital training courses for its online sellers so they can improve their sales, which would help improve Lazada’s own performance, too. It has launched what it calls a “sell to China” programme, which provides cross-border ecommerce opportunities for south-east Asian merchants by capitalising on parent Alibaba’s global platform.

Grab and Gojek have also been seeking growth in financial services. In 2020, Grab acquired wealth management start-up Bento and invested in Indonesian state-owned payment company LinkAja.

Like Sea, Grab has acquired a digital banking licence in Singapore through a consortium with Singapore Telecommunications. As for Gojek, it has acquired a 22 per cent stake in local lender Bank Jago, expecting to provide digital banking services on the Gojek superapp.

Other international companies are responding. Amazon.com of the US is increasing its presence in Singapore. In food delivery, Germany’s Delivery Hero is aggressively expanding in south-east Asia through its Foodpanda brand. Japanese messaging app Line has Line Man, which is among the most popular food delivery services in Thailand.

Looking ahead, the global economy is starting to rebound, backed by monetary easing and fiscal stimulus as well as the distribution of coronavirus vaccines. Some unlisted start-ups have started to receive more funds, with Gojek in November bagging $150m from Telkomsel, Indonesia’s state-owned mobile operator.

Listed companies such as Sea are already taking advantage of the stock market rally. In December, Sea raised almost $3bn through new share offerings for purposes “including potential strategic investments and acquisitions”. While most start-ups, including Sea, are still making net losses, the fresh capital should allow them to further expand, fuelling competition.

Mr Muljono of YCP Solidiance pointed out that the major digital players in the region such as Grab were rapidly expanding their services to become lifestyle apps, and big investors such as Chinese and US tech giants and local conglomerates preferred to invest in existing big players.

This “would mean the major players in south-east Asia would compete with the existing major players, while at the same time consolidating through various acquisitions”, he said. “Ultimately, this would result in a consolidated market in south-east Asia, led by several players, and backed by investment from across the globe.”

A version of this article was first published by Nikkei Asia on January 8 2021. ©2021 Nikkei Inc. All rights reserved

Related stories

By – glampingpassion.com

Original from: glampingpassion.com

By glampingpassion.com

published 2022-03-23 18:43:11